LLP registration in Coimbatore is crucial in India. Numerous business people who start another business are interest and confuse about this Distinction between Private Limit Organization versus the two associations offer many Maintaining a little to enormous business requires similar highlights, while additionally contrasting in certain perspectives. In this article, I translate the correlation of Private Limited Organization versus according to the perspective of a business person beginning another business.

Private Enlistment measure

The private limited organization enlistment measure and the LLP registration in Coimbatore enrollment measure are basically the same for certain distinctions in the records and forms petition in for coordination. There are ventures for incorporation of a private limited organization

1. Acquiring Computerized Mark Endorsement (DSC) for the proposed chief,

2. Acquiring Chief ID Number (Racket) for the proposed chief,

3. Getting name endorsement from M. MCA

4. Petitioning for inclusion.

LLP enlistment has a comparable interaction:

1. Acquiring Advanced Mark Authentication (DSC) for the proposed accomplices

2. Getting chief distinguishing proof Number (Clamor)/Assigned Accomplice ID Number (DPIN) for the proposed accomplices.

3. Name endorsement from M. MCA

4. Petitioning for addition. Both the private limited organization and the LLP are enroll with the Service of Corporate Issue and are give a testament of an enterprise.

The handling time for the joining of a organization and a likewise requires around 20 days to be incorporate with the two organizations.

Enrollment costs

At the point when government charges for consideration are essentially less expensive

Correlation of government charges for consideration of a private limited organization.

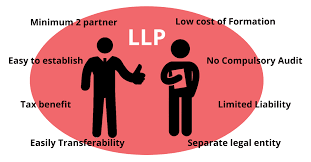

LLPs have been acquaint with address the issues of independent ventures and consequently LLPs

Appreciate low government charges for venture. Additionally, the quantity of archives needed to be imprint on non-legal stamp paper and authorize for enrollment is less when contrast with private limited organization enlistment.

Claim to fame

Both LLP and Private Limited Organization in Chennai offer comparable highlights. LLP and

The private limited organization are both separate lawful substances and have resources and

Obligations that are not quite the same as advertisers. Both the LLP and the private limited organization are reasonable for move, albeit the private limited organization in Chennai offers great adaptability with regards to move or circulation of private proprietorship. Both the and the private limited organization have a lasting life, except if shut by an advertiser or an equipped position.

It is a different legitimate substance enlist under the LLP Act, 200. The accomplices of the LLP are solely answerable for the obligations of the LLP. Accomplices have limited liability and are capable just to the degree of their commitment to the LLP.

Private Limited Organization is a different legitimate substance enroll under the Organizations Act, 2011. The chiefs and investors of a private limited organization are solely liable for the liabilities of the organization. Investors have limited liability and are obligate uniquely to the degree of their offer capital.

Possession

An exclusive organization offers greater adaptability for advertisers with regards to possession and proprietorship sharing. The responsibility for private limited organization is control by its shareholding and a private limited organization can have up to 200 investors. Further, since investors are not straightforwardly associated with the administration of the organization, there is a reasonable differentiation among investors and the board in a private limited organization. Hence, a private limited organization in Chennai is worthwhile with regards to proprietorship and the executives’ offices.

In LLP, there is no reasonable qualification among proprietors and the executives. In a LLP, LLP accomplices own the LLP and furthermore have the power to deal. In this manner, the accomplice in a LLP will be both the proprietor and the supervisor, while in a private limited organization, the investors (proprietors) don’t must have the board powers. A private limited organization is suggest for any business considering FDI or representative investment opportunities or value assets or investment reserves.

Consistence

Expense consistence is something similar for both private limited organization and LLP. Nonetheless,

LLPs have critical benefits with regards to consistence with the Service of Corporate Issues. On the off chance that the yearly turnover of LLP is Rs. 40 lakh and a capital commitment of Rs. 25 lakhs. A private limited organization, then again, needs to document its budget summaries with the Service of Corporate Issues each year.

A Pvt. Ltd. The organization is need to deliver nearly profit circulation charge. 16.50% at the hour of circulation of benefits to its investors. Such profit pay is tax-exempt in the possession of investors.

The duty structure for LLP is straightforward. LLP is dependent upon annual assessment as it were. Profit conveyance doesn’t matter . When the benefits are proclaim and burden by the LLP, the common pay is tax-exempt in the possession of the accomplices. Pay firm is charge at 30%.

The base discretionary expense is collect on both LLP and Pvt. Apply to Ltd. Organization.

Fines and punishments

LLP, The Service of Partnership Issues has higher punishments for LLPs for rebelliousness or late recording of archives, as a level expense of Rs 100 every day is charge if consistence isn’t kept up without a cap on liability. . Consequently, LLPs can bring heavy fines or punishments from the MCA for resistance. Accordingly, it is significant for the advertisers of the LLP to know about the due date and record the necessary archives in the recorder in an opportune way.

Different elements

Private limited organizations have existed longer than LLP and acquired wide acknowledgment in India and the world. Consequently, there are ground methodology and systems for private limited organizations. then again, is an as of late dispatch element in India.

A private limited organization gives its advertisers a preferable picture or remaining over a LLP. The private limited organization additionally appreciates great admittance to banks and unfamiliar direct speculation reserves.

Unfamiliar proprietorship

LLP: Outsiders are permit to put resources into LLP just with the endorsement of Save Bank of India and Unfamiliar Speculation Advancement Board (FIPB).

Private Limited Organization – Outsiders are permit to put resources into a private limited organization in Chennai

Organization under programmed endorsement course in many regions.

Presence or energy

Partnership-The presence of a partnership business relies upon the accomplices. May be for disintegration because of death of life partner.

The presence of isn’t subject to accomplices. Can be disintegrate just willfully or by request of the Organization Law Board.

Private Limited Organization – The presence of a private limited organization in Coimbatore doesn’t rely upon the chief or investors. Must be broke up by intentional or administrative specialists.